| EMOSI Score Range | Margin of Safety | Market Action |

|---|---|---|

| 01-79 | Very Low |

Invest Very Cautiously |

| 80-94 | Low |

Invest Cautiously |

| 95-104 | Moderate |

Continue Accumulation |

| 105-119 | High |

Continue Investing |

| 120-200 | Very High |

Invest Very Aggressively |

| What is Margin of Safety? |

|---|

| Margin of Safety(MoS) is an investing principle in which investors purchase securities only when their market price is significantly below their intrinsic value. |

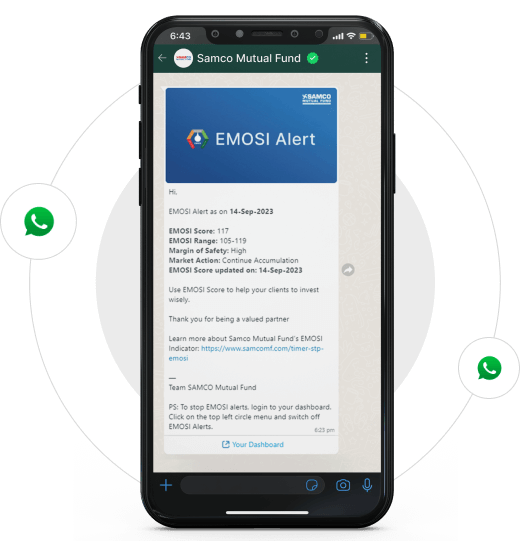

Now all Samco Mutual Fund empaneled partners can get EMOSI alerts right on their WhatsApp.

Please Note:This service is available only for Samco Mutual Fund’s empaneled partners. Post the empanelment process, WhatsApp alert will be activated in T+3 working days.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.